At the end of October 2025, reports appeared on the RuNet that British banks began assigning carbon points to their customers based on an analysis of their purchases. We have checked the correctness of this news.

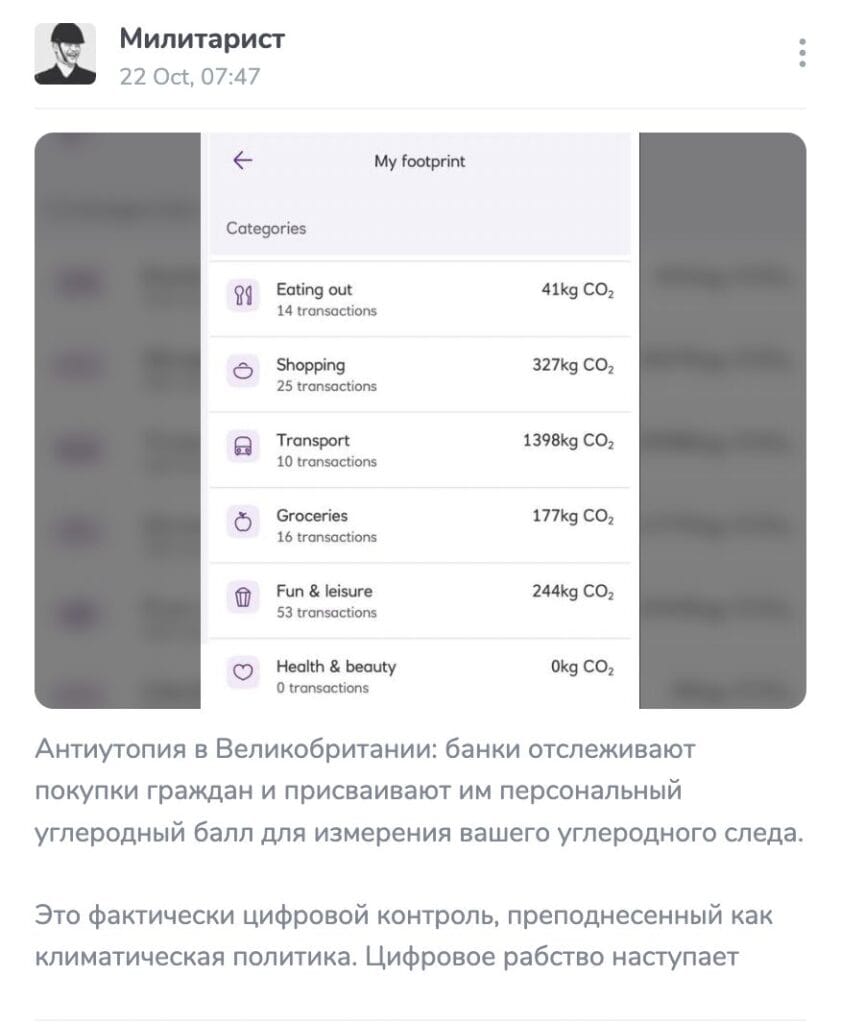

The fact that financial institutions in the United Kingdom, under the pretext of caring for the environment, began to monitor customer spending, wrote Russian-speaking informational portals, specialized resources about banking And technologies, social network users (“VKontakte", Threads, X, Facebook) and Telegram channels, including “ZeRada"(273,000 views at the time of writing this analysis), "Luka Ebkov"(182,000), "Militarist" (146,000), "Dmitry Vasilets"(106,000), etc. Many publications were accompanied by a screenshot of a banking application with calculations of the carbon footprint that the client left with his purchases. The authors of the posts express fears that in this way the “globalists” are establishing digital control over the population: supposedly, a spending limit will soon be introduced, determined by the carbon footprint and independent of the amount of money in the account.

Using Google's reverse image search, Verified determined that the viral screenshot was taken on a mobile device. application British bank NatWest. There really is a function for tracking your own carbon footprint, which is calculated based on the amount of the purchase and the location where it was made (restaurant, grocery supermarket, clothing store, beauty salon, etc.).

However, in other respects the authors of the posts distort reality. Firstly, this feature appeared in the application back in 2021, when NatWest concluded partnership with the company CoGo, specializing in technology solutions for measuring carbon footprint. Secondly, over four years, other banks, including outside the United Kingdom, signed similar agreements with this company: for example, the Australian Suncorp Bank, Hong Kong Bank of China and New Zealand Kiwi Bank. Third, “Verified” did not find information on the websites of these banks or in the news that the carbon footprint tracking function is enabled in the applications by default for all clients and will be used to impose restrictions. Representatives of NatWest in comments to the agency Reuters emphasized that the user can disable it at any time.

The benefits of implementing such a CoGo function explains on your website. The company cites research showing that many people would like to be more environmentally friendly and reduce CO emissions2but don't know how to do it. At the same time, respondents were not against banking applications helping them with this. By enabling the appropriate function, customers interested in combating climate change will be able to better monitor their own impact on the environment and, if deemed necessary, adjust their consumer behavior.

On the other hand, on the NatWest website notedthat the carbon footprint data displayed in the app is very approximate, as it is derived from an analysis of the type of store and transaction amount, but not a specific shopping cart. In other words, NatWest has no information about what exactly a person has purchased, which means it is impossible to accurately calculate what the carbon footprint of a purchase will be.

Moreover, even if banks received detailed data on a customer's spending, this would still provide a very rough idea of the actual climate impact of their purchases. Researchers from CoGo lead Here's an example: renting an outfit for a New Year's party instead of buying a new dress will reduce your environmental impact by almost the equivalent of cutting down four trees. However, what matters is not only the purchase and method of production of the outfit, but also how the client will use it in the future - whether he will wear it once to a party or will wear it for many years and then sell it to a consignment store. It is impossible to take into account all such factors only on the basis of banking transactions, and therefore limiting customer spending only on the basis of average data and mathematical modeling is groundless.

The rise in carbon dioxide emissions has been causing concern among researchers for decades. Countsthat to avoid future severe climate change, it is necessary to reduce global CO emissions by 20302 by 43%. The corresponding goal was enshrined in Paris Agreement, which was signed in 2015 by representatives of 194 states and the European Union. However, according to the UN, at the moment, the joint efforts of different governments to achieve this goal are insufficient and will lead to a decrease of only 2.6%. In this context, it is not surprising that individual companies and their customers, committed to being environmentally responsible, are trying to implement solutions to reduce their carbon footprint through their own efforts.

So, while some UK banking apps do indeed allow you to calculate your carbon footprint based on transaction data, this information is significantly skewed on social media. Firstly, this feature has been around for several years, secondly, not all banks in the United Kingdom offer it (but it is available to clients of some banks in other countries), and thirdly, it is, in fact, an information service, and not a control tool - the client decides whether to enable it or not. Such carbon footprint calculations are very approximate, since the corresponding services have a very limited set of purchase data. Verified found no reputable news sources, statements or even expert recommendations to impose any restrictions or other sanctions on Britons with poor carbon scores on banking apps.

Cover photo: ChatGPT / "Verified"

- United Nations. For a livable climate: Net-zero commitments must be backed by credible action

- WWF. How big is your environmental footprint?

- Is it true that giving up meat is good for the environment?

- Is it true that artificial leather causes significantly less harm to the environment than natural leather?

- Is it true that the World Economic Forum has proposed euthanizing a million domestic cats and dogs to combat climate change?

If you find a spelling or grammatical error, please let us know by highlighting the error text and clicking Ctrl+Enter.