In some sources you can read that in the crisis year of 2020, the American authorities took an unprecedented step and produced a record cash supply, putting the country at risk of huge inflation. We checked whether such figures are indeed true.

This is what was reported on the information site Hash Telegraph in October 2020: “Since September 2019, the Federal Reserve has lent more than $9 trillion to its primary dealers using massive emergency repo operations, according to the study. A recently released report showed that the Fed reports daily lending volumes but does not inform the public about the recipients. It is estimated that in 2020 alone, the United States created 22% of all US dollars issued since the creation of the nation.”

Similar information is reported by the Russian-language portal Incrypted, as well as English-speaking Bitcoin.com, Reddit, Bid-Over.com and a number of other resources.

Undoubtedly, in 2020 the world faced a global economic crisis caused primarily by the coronavirus pandemic. Already in September, UN Secretary General Antonio Guterres stated about “the largest job losses since the Great Depression.” The crisis did not spare the United States of America, which plays a key role in the global economy. If at the beginning of the pandemic inflation in the country reached relatively modest levels, then at the end of 2021 broke a 39-year-old record — 7%. However, the news of 22% of all banknotes in one year still seems incredible.

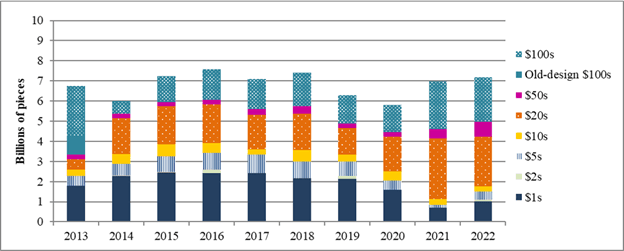

The role of the central bank in the United States is performed by the Federal Reserve System (FRS). On the official website of the organization you can see the volume of orders for the production of banknotes received by the Bureau of Engraving and Printing, both for a specific year and for the last several years. Let's take a look at the one posted there schedule:

There are the same data in in numbers - in the number of banknotes of each denomination and in the total volume of cash supply. From them we see that 2020 was not a record year at all for either indicator. Yes, in April 2020 (fiscal year runs from October to September) Fed re-ordered approximately a million more bills (plus 20% of the original order), bringing the total amount of money printed to $185.7 billion. But this, obviously, cannot account for 22% of all dollar bills not only in the entire history of the United States, but even in the last decade. Note also that individual American coins (without banknotes) do not constitute a significant share of the total volume of cash, but even with them in 2020 nothing extraordinary happened.

Where did the information about 22% come from then? If we take a closer look at some of the news that interested us, we will be able to notice that in parallel we are talking about "existing" or "circulating" dollars. It may seem that “dollars ever issued” are the same set, but this is far from true. On the Federal Reserve website you can get acquainted with the average expected lifespan of each popular denomination note ranging from $1 to $100. As you can see, the most common banknotes - five and ten dollar bills - last on average about five years, after which they are withdrawn from circulation and destroyed. Under these conditions, a 22% increase in the amount of money (or the number of banknotes) in one year does not look like something extraordinary. Moreover, we can notice, that in 2020-2021 the volume of the American monetary aggregate M0 (physical cash in circulation) increased noticeably, but on a secular scale this does not look like any extraordinary growth, and at the beginning of this year this figure fell.

Thus, the information about 22% of dollars printed “for all time” is not true.

Not true

If you find a spelling or grammatical error, please let us know by highlighting the error text and clicking Ctrl+Enter.